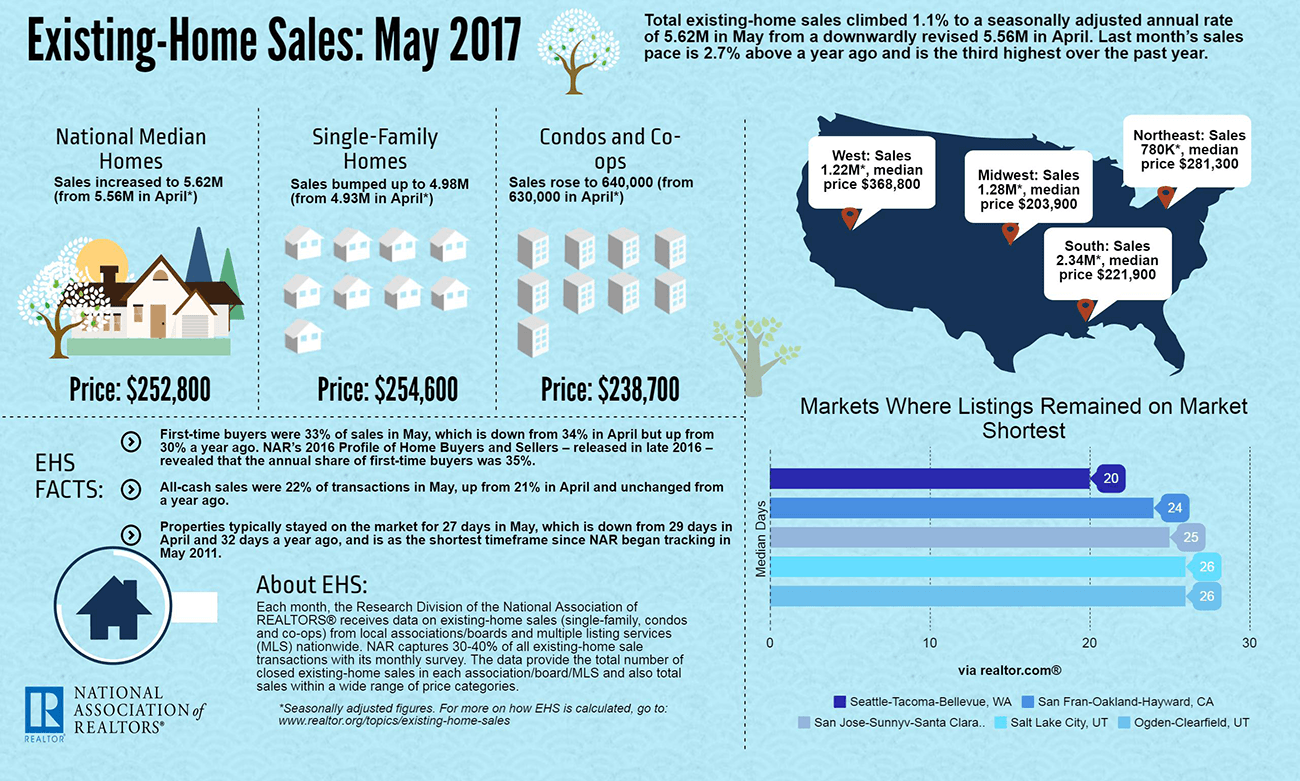

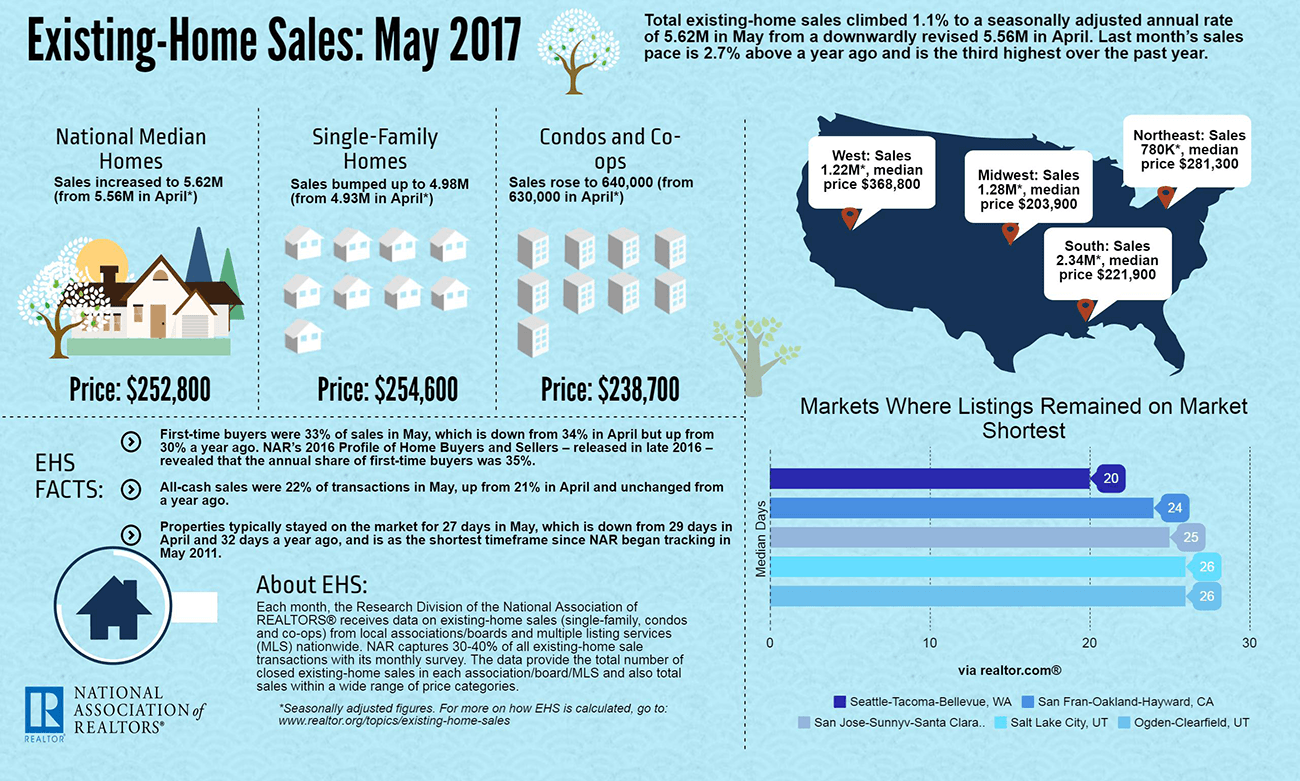

Data about May home sales and prices suggest that the market is continuing to gain momentum. More houses are being sold, and more quickly, than previous months in all regions except the Midwest. Overall, the pace of total existing-home sales was 2.7 percent higher from May 2016. 55 percent of those homes were on the market for less than a month - an average of 27 days, two days shorter than the April data suggested. However, the quick timeline of home sales hints at a potential long-term problem: Houses are being snapped up quickly as inventory remains tight. That high demand and lack of supply also continued to push sale prices higher - good news for those who already own, but a sign that homeownership is becoming less and less affordable for those who haven’t yet gotten on the proverbial ladder. Havard’s State of the Nation’s Housing 2017 study illustrates the widening gap: The market’s upswing comes as a welcome relief to those who saw their property values plummet during the Great Recession. Last month's median sale price was $252,800, 5.8 percent higher than May 2016. At the same time, however, new construction activity is still sluggish. The number of new housing projects started in May was down 5.5 percent over the month and 2.4 percent on the year. Multi-unit structures like apartment buildings fared even worse, as stats fell 9.8 percent.

Data about May home sales and prices suggest that the market is continuing to gain momentum. More houses are being sold, and more quickly, than previous months in all regions except the Midwest. Overall, the pace of total existing-home sales was 2.7 percent higher from May 2016. 55 percent of those homes were on the market for less than a month - an average of 27 days, two days shorter than the April data suggested. However, the quick timeline of home sales hints at a potential long-term problem: Houses are being snapped up quickly as inventory remains tight. That high demand and lack of supply also continued to push sale prices higher - good news for those who already own, but a sign that homeownership is becoming less and less affordable for those who haven’t yet gotten on the proverbial ladder. Havard’s State of the Nation’s Housing 2017 study illustrates the widening gap: The market’s upswing comes as a welcome relief to those who saw their property values plummet during the Great Recession. Last month's median sale price was $252,800, 5.8 percent higher than May 2016. At the same time, however, new construction activity is still sluggish. The number of new housing projects started in May was down 5.5 percent over the month and 2.4 percent on the year. Multi-unit structures like apartment buildings fared even worse, as stats fell 9.8 percent.

Source: The National Association of REALTORS®

Data about May home sales and prices suggest that the market is continuing to gain momentum. More houses are being sold, and more quickly, than previous months in all regions except the Midwest. Overall, the pace of total existing-home sales was 2.7 percent higher from May 2016. 55 percent of those homes were on the market for less than a month - an average of 27 days, two days shorter than the April data suggested. However, the quick timeline of home sales hints at a potential long-term problem: Houses are being snapped up quickly as inventory remains tight. That high demand and lack of supply also continued to push sale prices higher - good news for those who already own, but a sign that homeownership is becoming less and less affordable for those who haven’t yet gotten on the proverbial ladder. Havard’s State of the Nation’s Housing 2017 study illustrates the widening gap: The market’s upswing comes as a welcome relief to those who saw their property values plummet during the Great Recession. Last month's median sale price was $252,800, 5.8 percent higher than May 2016. At the same time, however, new construction activity is still sluggish. The number of new housing projects started in May was down 5.5 percent over the month and 2.4 percent on the year. Multi-unit structures like apartment buildings fared even worse, as stats fell 9.8 percent.

Data about May home sales and prices suggest that the market is continuing to gain momentum. More houses are being sold, and more quickly, than previous months in all regions except the Midwest. Overall, the pace of total existing-home sales was 2.7 percent higher from May 2016. 55 percent of those homes were on the market for less than a month - an average of 27 days, two days shorter than the April data suggested. However, the quick timeline of home sales hints at a potential long-term problem: Houses are being snapped up quickly as inventory remains tight. That high demand and lack of supply also continued to push sale prices higher - good news for those who already own, but a sign that homeownership is becoming less and less affordable for those who haven’t yet gotten on the proverbial ladder. Havard’s State of the Nation’s Housing 2017 study illustrates the widening gap: The market’s upswing comes as a welcome relief to those who saw their property values plummet during the Great Recession. Last month's median sale price was $252,800, 5.8 percent higher than May 2016. At the same time, however, new construction activity is still sluggish. The number of new housing projects started in May was down 5.5 percent over the month and 2.4 percent on the year. Multi-unit structures like apartment buildings fared even worse, as stats fell 9.8 percent.  Source: The National Association of REALTORS®

Source: The National Association of REALTORS®